The State of the North American Passenger Airline Industry—And What’s on the Horizon

By ALPA Economic & Financial Analysis Department Staff

More than halfway through 2016 it seems that the North American passenger airline industry is performing just as it did in 2015:

Mainline carriers continue to post record profits as they benefit from low fuel costs, and Fee-for-departure (FFD) carriers continue to face a very competitive environment as they attempt to secure flying and retain pilots.

However, further examination of this year’s trends reveals that other important factors are affecting today’s operations and future outlook. Some of these factors are external to the industry but have a significant impact, and others are more particular to the industry and specific sectors.

Anemic economic growth

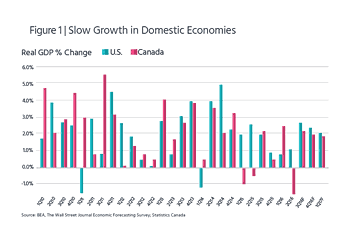

While the U.S. and Canadian economies continue to grow, the trend is an anemic one (see Figure 1), and the global economy as a whole is weakening (see Figure 2). U.S. economic growth is tracking at approximately 1 percent so far for 2016. This is part of what seems to be a longer trend of low growth the U.S. has been experiencing. Per-person gross domestic product (GDP) rose by an average of 2.2 percent annually from 1947 through 2000—but starting in 2001, per-person GDP growth has averaged only 0.9 percent. And second quarter 2016 GDP grew by only 1.1 percent, far below the 2.5 percent that had been forecast. This same slow trend is projected to continue for the next two years, with GDP expected to grow at just above 2 percent through 2018.

The Canadian GDP is anticipated to grow at a similar low rate—essentially flat in the first half of 2016 and projected to increase 1.4 percent for the remainder of 2016 and 2 percent in 2017 and 2018. It’s estimated that the economic impact of the wildfires in Alberta in the second quarter of 2016 negated all of the Canadian economy’s GDP growth this year.

On a more positive note, U.S. unemployment has dropped to just below 5 percent, and average wages continue to increase—up 2.4 percent over the last 12 months.

Global economic uncertainty

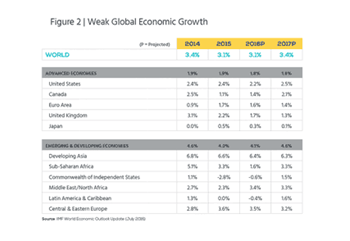

Global economic activity has softened, with diminished prospects for growth as downside risks have increased. Global trade is expected to grow very modestly this year, with worldwide GDP growth estimated to increase at only 3.1 percent. According to the International Monetary Fund, a GDP growth rate of 3 percent represents a technical recession so, in essence, global economic growth is projected to remain flat year over year.

Several factors are eroding economic confidence, resulting in economic forecasts continuing to be revised downward. These factors include

- rising economic and political uncertainty due to Brexit still unfolding, with the likelihood of outcomes being much more negative than currently projected.

- increased concern in the U.S. over the impact of a potential increase in interest rates as well as the outcome of the presidential election.

- continued reliance on credit as a growth driver, heightening the risk of a disruptive adjustment in China’s economy.

- weak commodity prices, particularly oil prices that have negatively impacted the economies of oil-producing nations and even local economies in the U.S. and Canada.

- emerging market economies that are becoming more susceptible to financial stability risks.

- geopolitical tensions and terrorism, which have escalated in recent months.

- other ongoing concerns, including climate-related factors such as drought in East and Southern Africa and diseases such as the Zika virus.

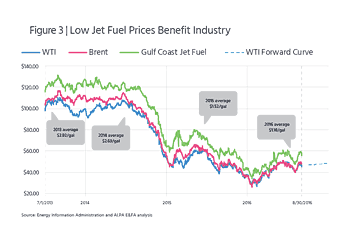

Fuel prices expected to rise in 2017

While low fuel prices have adversely affected some economies, they continue to have a very positive effect on the airline industry (see Figure 3). Through August, the price of West Texas Intermediate (WTI) crude oil has averaged about $40 per barrel this year—17 percent below the 2015 average price and 57 percent below the average price of WTI crude in 2014. The price per gallon of jet fuel in the U.S. has averaged $1.18 compared to an average price of $1.52 in 2015 and $2.69 in 2014.

These low fuel prices have contributed significantly to record profits mainline carriers have posted. However, according to the International Energy Agency, the world’s oversupply of crude oil is fading, which will result in the overall cost of crude oil rising. Future projections indicate that fuel costs will start to rise in 2017 with Brent crude forecast to exceed $60 per barrel next year.

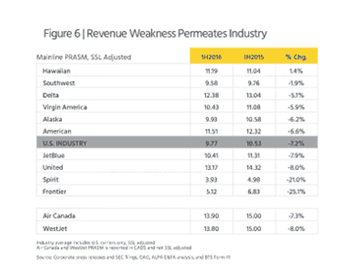

Revenue weakness permeates industry

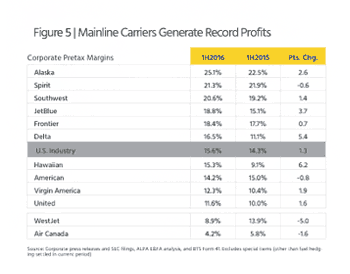

U.S. mainline carriers continued to post record profits in the first half of 2016 (see Figure 5). In the U.S., the second quarter 2016 mainline carrier pretax profit was up 0.6 points over the second quarter of 2015. And in the first half of 2016, all U.S. mainline carriers posted double-digit margins.

However, revenue weakness is beginning to permeate the industry as a result of increased pricing pressures, weaker international markets, and an anemic global economy (see Figure 6). Total revenue in the U.S. was down 2 percent in the second quarter of 2016, and passenger revenue per available seat mile (PRASM) continues to decline.

Domestic markets, however, are performing better than international markets, as global economic weakness and fears of terrorism and political instability are affecting international travel. As a result, carriers are revising their capacity growth plans for the second half of the year to better match supply to demand and are redeploying lift to areas with more revenue opportunities. Most of the projected growth will be at the low-cost carriers (LCCs), while megacarriers will focus on aircraft gauge and reconfiguration rather than adding new hulls.

Overall, U.S. airline capacity will grow by only 3.6 percent in 2016, with mainline carriers growing by 2 percent and LCCs growing by 8.5 percent. In 2017, LCCs are expected to grow by 6 percent, while mainline carriers’ system growth is projected to be 2.4 percent. Though domestic growth continues to be strong, internationally mainline carriers are expected to grow by just 0.6 percent in 2016 and by just slightly more than 1 percent in 2017.

As weak revenue trends are expected to continue through 2017, carriers are likely to focus more on cost controls to ensure profitability. Industry results clearly show the significant advantage that low fuel costs are having on airlines’ bottom lines (see Figure 7).

Total cost per available seat mile (CASM) increased year over year for most mainline carriers due to higher labor costs from new collective bargaining agreements and higher maintenance costs. However, total fuel costs for mainline carriers dropped an average of 30 percent year over year. (Southwest was the exception as it had to account for fuel hedge losses.)

Low fuel costs and a relatively healthy North American aviation market are resulting in record profits and providing airlines an opportunity to improve their balance sheets. Airlines are generating healthy levels of free cash flow; debt is being paid down; and the industry has benefitted from some of the lowest borrowing rates in years, which has resulted in declining interest expense. As a result, various stakeholders are expecting to receive their fair share of the profits.

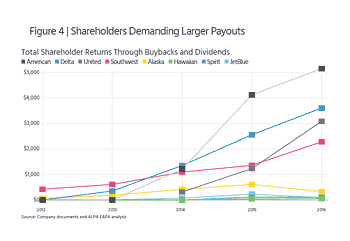

Sharing the wealth

After years of living under concessionary agreements, labor is increasing its demands for improved wages, benefits, and working conditions. Shareholders are also placing increased pressure on airlines to provide them with higher returns on their investment after several years of little to no return on shareholdings (see Figure 4). These payouts are coming in the form of share buybacks and dividend payments.

Further, airlines want to be regarded as investment-grade companies, and larger carriers are focused on achieving a higher credit rating. Early this year, both Fitch and Moody’s upgraded Delta’s rating, propelling the company to the ranks of Southwest and Alaska Air Group as the only investment-grade U.S. passenger airlines. Both American and United are also focused on attaining this goal.

Some industry profits are also being spent on much-needed infrastructure requirements. Capital expenditures have been increasing as airlines can now afford to replace older aircraft with new aircraft that are more energy efficient and technologically advanced (see Figure 8). In addition to aircraft expenditures, airlines are also focusing on replacing aging IT and baggage systems and upgrading technology, which will result in improved operations as well as enhanced customer service.

Some industry profits are also being spent on much-needed infrastructure requirements. Capital expenditures have been increasing as airlines can now afford to replace older aircraft with new aircraft that are more energy efficient and technologically advanced (see Figure 8). In addition to aircraft expenditures, airlines are also focusing on replacing aging IT and baggage systems and upgrading technology, which will result in improved operations as well as enhanced customer service.

The question now is where is the industry headed over the next few years? As a result of global economic uncertainty and ongoing revenue weakness, future projections indicate that PRASM will continue to decline through 2017, fuel costs will start to increase, and mainline industry profits may peak this year (see Figure 9).

The question now is where is the industry headed over the next few years? As a result of global economic uncertainty and ongoing revenue weakness, future projections indicate that PRASM will continue to decline through 2017, fuel costs will start to increase, and mainline industry profits may peak this year (see Figure 9).

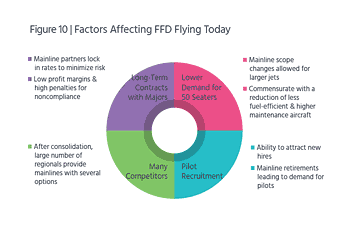

FFD sector still challenged by unique business model

Unlike the mainline sector, the FFD sector continues to face challenges that are the direct result of that sector’s unique business model (see Figure 10). FFD carriers are constrained within very long-term capacity-purchase agreements, with little ability to increase the earnings negotiated for the term of those agreements. As a result, earnings are locked in for periods of 10 years or more, while overall profits have increased for the mainline carriers. This places further pressure on FFD carriers to constrain cost increases as much as possible.

Mainline requirements for feeder flying have been changing, with an increased focus on 76-seat jets as 50-seat aircraft are gradually eliminated from feeder fleets. Overall, regional capacity has decreased by about 1.35 percent in the last two years and is projected to increase by only 1.2 percent for the next three years. In addition, consolidation in this sector has been limited, so competition for flying opportunities is fairly intense—driving down bids to obtain that flying and constraining cost increases even further (see Figure 11 and 12).

Another complicated factor for FFD carriers is their varied ownership structures. Several carriers are wholly owned by their mainline partner; two carriers are publicly held, one of which is in bankruptcy; and others are privately held by a variety of shareholders. Those that aren’t wholly owned have a fiduciary responsibility to provide returns to their shareholders, i.e., earn a profit, whereas wholly owned subsidiaries are considered cost centers and aren’t necessarily driven to earn a profit. Further compounding these differences is the varied feeder aircraft ownership structure: some FFD carriers own and/or lease their aircraft and are obligated to incur those ownership costs. Other FFD carrier aircraft are owned by the mainline and consequently don’t have the same ownership obligations.

Over the last two years, pilot retirements at mainline carriers have surged, and the trend will continue over the next several years (see Figure 13). It’s projected that between 2016 and 2025, approximately 23,000 pilots will retire from several mainline carriers. Along with strong growth at LCCs, these retirements will result in larger attrition numbers at FFD carriers as pilots move to mainline carriers.

Following years of stagnation, these increased opportunities at mainline carriers are positively affecting pilot career progression; however, it’s proving to be very difficult for many FFD carriers to fill the vacated positions. Compensation and benefit levels at FFD carriers are often inadequate and not commensurate with the experience and education required to become a pilot. As a result, fewer pilots are showing interest in pursuing careers with U.S. airlines. Several FFD carriers are beginning to realize that they need to offer better compensation and career-progression packages to attract and retain pilots and have tried to address these needs through bonus payments (see Figure 14) and career-progression opportunities.

While one-time bonuses may prove attractive to prospective pilots, this falls far short of what is actually needed—an overall improvement in the total pilot compensation and benefit package.

Given the unique nature of this business model, these challenges cannot be addressed only by the managements of the FFD carriers. Mainline partners also need to help find solutions so that they can guarantee their feed. As noted earlier, one large FFD carrier, Republic Airlines, has already filed for bankruptcy protection partly as a result of the unique challenges facing this sector.

Canadian carriers face similar issues as U.S. carriers

In terms of outside forces, Canadian carriers are experiencing the same issues as their U.S. counterparts: a national economy that’s growing at a very slow pace, overall global economic weakness, financial market uncertainty, and the threats of geopolitical instability and terrorism. In addition, falling oil prices have taken a particular toll on the Canadian economy. Recent estimates suggest that the supply costs for extracting, producing, and transporting product from the Canadian oil sands can range from $60 to $90 per barrel, depending on the technology employed. With WTI crude oil averaging around $40 per barrel this year, there’s little to no economic incentive to start new production projects. And a strong U.S. currency has also hurt, as the Canadian dollar has lost value compared to the U.S. dollar, although the decline has lessened in 2016 compared to 2015 (see Figure 15).

This latter issue further impacts Canadian carriers as they deal with debt obligations—such as lease, financing, and fuel costs—in U.S. dollars. While Canadian carriers continued to generate strong pretax profits in the first half of 2016, larger carriers’ profits are shrinking partly due to the stronger U.S. dollar.

Canadian carriers are also growing at a faster pace than Canadian and global GDP growth. Collective capacity among Canadian carriers grew about 7 percent in the first half of 2016 compared to the same period in 2015. And scheduled capacity by Air Canada and WestJet is projected to grow approximately 19 percent and 11 percent, respectively, for the remainder of the year. This trend may result in supply exceeding demand, which could lead to lower fares, yields, and profits—a trend that industry analysts will keep a close eye on over the coming year.

ALPA’s Canadian members’ airlines are diverse in terms of their operations, from regularly scheduled passenger carriers to charter and cargo operators. Yet despite this diversity, they all have had to deal with the challenges presented by rising fuel prices, growing capacity due to increased competition on regional routes, the strengthening U.S. dollar, and declining yields from oil-market-related traffic.

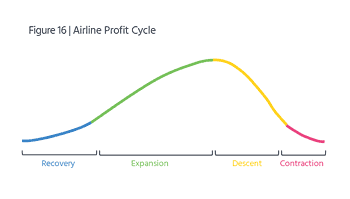

The outlook for the remainder of 2016 and beyond

Despite some skeptics’ views, the airline industry remains a cyclical industry. And while it has undergone some major restructuring, it continues to track the airline profit cycle (see Figure 16). However, all airline sectors are not in the same position in the cycle, and within certain sectors, individual carriers are at different points within the cycle.

The last seven years have been ones of expansion for the mainline passenger carriers, i.e., revenue growth, higher yields, strong profits, and stronger balance sheet performance. And the results have improved strongly from year to year. However, 2016 may prove to be a pivotal year in the cycle. A weaker global economy, expected increases in fuel prices, increased geopolitical tensions and terrorism, weakening revenue, and cost pressures all seem to indicate that airline profits may be peaking.

This industry also continues to face new and evolving challenges on a regular basis, such as government taxation, increased competition from subsidized carriers, and emerging business models. Collectively, these factors may be enough to lead the industry into the next phases of the profit cycle. That isn’t to say, however, that the descent and contraction of this cycle have to be severe or even result in negative earnings. In fact, airlines are in a much stronger financial position today than they were during the past down cycle and will likely be able to weather economic downturns.

FFD carriers have operated on a similar cycle, but not at the same time as mainline carriers. What’s unique is that individual FFD carriers have recently been in different positions in the cycle, depending on their particular situation.

ALPA’s Economic & Financial Analysis Department will continue to monitor and analyze the various economic and financial indicators that affect the airline industry, as they play a critical role in the career success of the Association’s members and the piloting profession.

Look for a detailed analysis of the air cargo sector in next month's Air Line Pilot.