FedEx Express MEC Investigates Groundbreaking Retirement Plan

By Kevin Cuddihy, Contributing Writer

“Will I have enough money saved for retirement?” is a question many people ask, and pilots are no different. The worlds of defined-contribution (DC) and defined-benefit (DB) plans can be confusing and murky, leaving many pilots with questions about their future beyond an airline cockpit.

At FedEx Express, members of the Master Executive Council (MEC) have been hard at work over the past few years researching a unique and groundbreaking plan that they believe will provide a better retirement for their pilots, with decreased risk and increased benefits. With years of research, plus input from ALPA staff and industry consultants, they’re now ready to showcase the plan and—pending approval from the FedEx pilots—begin negotiating a letter of agreement prior to the pilot group’s 2021 Section 6 negotiations.

The history

The pilot group’s current retirement plans were put into place in 1999, when management offered both a company-funded DB plan and a DC plan. Two elements of the DB plan, however, would later become contentious. The DB plan provided for retirement benefits based on a pilot’s highest five years of earning, with a cap of $260,000—which would become problematic as salaries grew but the cap didn’t. The plan also capped a pilot’s effective years of service to 25, which would become an issue when pilot retirement age was pushed back to 65.

In 2006 the pilot group returned to the negotiating table. The MEC leaders discussed attempting to bargain for an increase to the average earnings cap, but they eventually agreed that the $260,000 was still adequate. Instead, the MEC focused on the DC plan and negotiated an increase to the company’s contribution, from 6 percent to 7 percent, as well as a multiplier for late-career pilots.

According to Capt. Chuck Dyer, the pilot group’s former MEC chair, there was an expectation postcontract that the next contract would include an increase to the DB salary cap. “Over the years—right or wrong—it became expected and even assumed,” he explained, “and the story evolved into the company having promised a cap increase.” Although the pilots had expected the increase, nothing was in writing. “It set us up for a really hard fall,” Dyer acknowledged.

After an interim contract in 2011 that focused mostly on incremental pay increases, changes to safety programs, and deferred bargaining on work rules due to the FAA’s impending changes to fatigue regulations, the two sides ultimately returned to the negotiating table in 2014. Rather than discussing the DB cap, the company proposed freezing the DB plan and moving forward solely with a new DC plan. New hires would participate in a DC plan, while current pilots would keep their DB plan and grow their DC plan.

The retirement discussion became so divisive, Dyer said, that the MEC decided to table the push for a cap increase, opting instead to bargain for a small DB multiplier to provide an increased benefit for those within a few years of retirement, plus an increase to the DC contribution percentage. The MEC would then potentially tackle a major revamp of the entire retirement plan after negotiations were complete. Ultimately, a cash bonus for those willing to give the company advanced notice of retirement was settled on in the final round of bargaining.

The contract signed in late 2015 also included an increase in DC contributions to 8 percent, which rises to 9 percent in 2020. However, management’s actions raised a question for Dyer that began to move the retirement plan issue forward.

During mediation, management offered a compromise in which new pilots could choose either a DB or a DC plan—but when one plan fell below a certain sign-up level, it would be done away with. “The company wanted something that allowed the auditors to see the end of the DB plan,” explained Dyer. “That indicated to me that the company had a real cost problem. If we could solve that problem and improve our plan, we’d have a way forward.”

Though the pilot group ratified the agreement, it was a struggle. “It wasn’t what the pilots expected,” Dyer said, “mostly due to the retirement situation.” The 57–43 percent margin showed that the pilot group still wasn’t happy. With the ink barely dry on the contract, the MEC got back to work.

The issues

“The end of the 2015 negotiations process was brutal,” admitted Dyer. “We had to tell our pilots that we weren’t able to get them what many wanted. Starting to research a new retirement plan, however, was a way to be constructive and show our pilots that we were working on it.”

While beginning to research various plans, the MEC first discussed the general pros and cons of both DB and DC plans. With a DB plan, the majority of the risk falls on the company—Is there enough money? Is the company investing properly? In a DC plan, the risk falls on the individual—Am I putting enough into my account? Am I choosing the right funds? How much money do I need to retire? In addition, after passage of the Pension Protection Act of 2006, companies had to change the way they handled their DB plans, which added funding, administrative, and other indirect costs.

“In conversations with management personnel,” Dyer noted, “they relayed to us that for every dollar they put into our DB plan it cost them much more to support it.” Armed with information shared by the company, the pilot group asked two different consulting groups if that was true; both confirmed that it was. That was a light-bulb moment for Dyer. “When I found out, I understood why raising the cap was such a huge deal—it would raise the company’s cost exponentially.”

But moving solely to a DC plan wasn’t something the MEC wished to do. With a longer life expectancy and a volatile economy, a sole DC plan could prove troublesome for the pilots. In addition, IRS rules limit the amount of pretax money that can be placed into a DC plan, which would negatively affect many of the longer-term pilots at the top of the seniority list.

Capt. Pat May (FedEx Express), chair of his pilot group’s Negotiating Committee, leads one of multiple meetings held to educate the pilots about the proposed new retirement plan.

The research

The MEC began researching alternative retirement plans. The group investigated an approach offered by one consulting group but determined it wasn’t a good fit. However, it confirmed that in addition to DB and DC plans there was a “third way.”

During his research, Dyer read the book Reimagining Pensions: The Next 40 Years, edited by Olivia Mitchell and Richard Shea. Dyer e-mailed Mitchell, explaining the pilot group’s situation. She responded, suggesting that he contact David Blitzstein, a retirement consultant.

“I was immediately interested in working with the pilots,” explained Blitzstein, “because I was impressed that the leaders had done their research and gone to the extent that they had to find a way to make their retirement program more sustainable.” His experience with unions was the icing on the cake: Blitzstein spent 36 years in the labor movement, specializing in employee benefits negotiations with the United Food and Commercial Workers and the United Mine Workers of America.

By December 2016, the MEC had hired Blitzstein as a consultant. He reviewed the figures management had provided, confirming the prohibitive costs and risks management was taking to maintain the DB plan. Blitzstein presented the MEC with an alternative.

“My contribution was twofold,” said Blitzstein. “It was strategic in terms of helping formulate a game plan that included both the economics of the pension plan and what would serve the best interests of the pilots. But there was also a collective bargaining component for which my experience was helpful. I was able to provide a strategic plan for how to communicate with management and with the pilot group.”

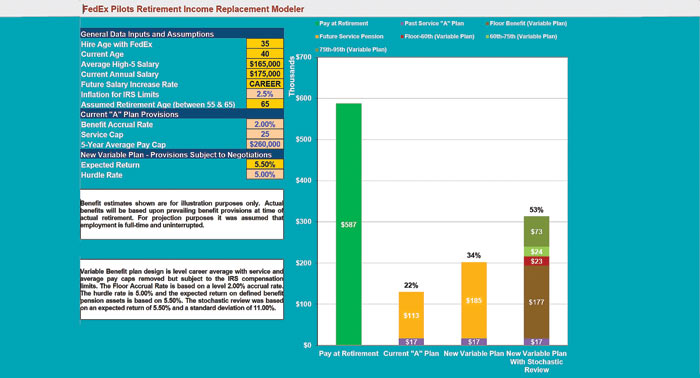

Blitzstein also suggested that the MEC hire Cheiron, an actuarial firm, to model different hybrid plan designs. One of the first things Cheiron did was to create a custom interface for the MEC. “It’s an enormous tool that allowed us to look at every possible scenario,” explained Capt. Pat May, the pilot group’s Negotiating Committee chair. “We could layer in figures to determine the impact of changes to the cap, accrual rates, and just about anything else. And it also showed a complete picture of the company’s funding—what a plan costs the company and how that changes with each variable.”

By inputting management’s data into Cheiron’s interface, it soon became evident that two models outshined the others: a variable accrual model and a variable-benefit model, with the latter proving the best option.

“We wanted to recognize the restrictions in bargaining that the company presented but still have a well-balanced plan for our pilots that contained DB and DC elements,” acknowledged May. “Once we understood the variable-benefit plan, we knew we had something.”

A variable-benefit plan shares the associated risks with both the plan corporate sponsor and the individual. The company funds the plan and bears the noninvestment risks, while the individual bears the investment risks. Plan funding volatility is all but erased for the company, while the fear of unsustainable pension financing is removed for the individual. “The pilots improve their retirement security while the company finds a way to stabilize pension costs, which allows it to compete more effectively,” Blitzstein noted.

The basics

The company funds the plan annually at a negotiated sum. Employees receive shares in the plan based upon salary and years of service. The number of shares an employee owns increases as his or her salary and years of service increase. The value of a share can either increase or decrease depending on the investment market.

The fund has what’s called a “hurdle rate”—the expected rate of return each year, usually around 5–6 percent. If the invested funds reach that hurdle rate, everything stays the same; otherwise the value of a share changes based upon the difference between the hurdle rate and the actual rate of return on investment. Additionally, the fund can include a cap on annual increases, with all funds over that cap going into a stabilization reserve—which can then be used to help finance the plan in down years.

Say the plan has a hurdle rate of 6 percent and a cap of 10 percent. In a year in which investments increase 15 percent, the share would increase based upon a calculation using the 10 percent cap. All additional funds would go into a stabilization reserve. And if the following year investments increase only 3 percent, the funds from the stabilization reserve could be used to buttress share value.

This benefits the company because it can budget stable contributions over the long term, and it benefits the employee because there’s the potential to regularly improve benefits when investment returns exceed the hurdle rate. Because plan benefits increase or decrease with actual investment changes, the variable-benefit plan eliminates a major expense for companies—the payment of expensive variable-rate premiums when plans are underfunded.

This type of plan addresses many of the concerns regarding FedEx’s current DB plan:

- It eliminates the average salary cap and accrues solely as a percentage of pay.

- It allows for accrual throughout a pilot’s entire career without a cap of 25 years.

- It limits the possibility of a decrease in funds with a stabilization reserve.

- At retirement, the pilot can convert to a flat lifetime annuity or choose an annuity that continues to adjust to investment returns.

However, a few pilots could see a potential downgrade due to the plan change. “We’d keep a close eye on which pilots might be negatively affected by any change,” said May. “We’d need to be able to identify them, quantify the value, and have a plan in place to bring them up to whole or better than whole.” Otherwise there’d be no agreement, according to Dyer. “No pilot would be left worse off under the new plan—at the very least, the pilot would get the same benefit that he or she would have by continuing under the DB plan. And in the vast majority of circumstances, the benefit would be greater than the current plan design.”

The next steps

The FedEx Pilot Individual Modeler allows a pilot to enter his or her personal data to determine how the new plan would affect retirement funding.

Once the MEC determined what it felt was the best course of action for the pilot group, it was time to educate and inform the pilots—which included sharing the custom model Cheiron created to show the pilots how they’d personally benefit from the proposed plan. “The pilots can plug in various numbers and circumstances and see how they’d specifically be affected—costs, benefits, even future life expectancies,” said Dyer.

The company provided flight operations rooms for the MEC to hold informational meetings and obtain pilot feedback. These focus meetings provided pilots an opportunity to learn more about the plan, ask questions, and express their opinions.

“The feedback has mostly been good,” said May. “Pilots are still working through the concept. I think there’s a completely expected and reasonable amount of cautiousness. We have a very good retirement plan. When you discuss making changes, it’s human nature that people are cautious.

“We’ve been very slow and methodical about this entire process,” May continued. “We’ve taken plenty of time to introduce a new concept to the pilots and help them understand our constraints and why we want to move forward with this new plan—to hopefully improve their retirement. We’ve provided a massive amount of education, and I think the pilots are at a point where they understand the benefits and the associated risk/reward.”

Blitzstein predicts that this model could be a game changer. “I think this whole idea of risk sharing is the future of defined-benefit plans,” he said. “I believe that once some high-level examples are in place—if this plan gets approved and publicized, for instance—people will take note and realize that there are solutions to the retirement dilemma that are much more robust and much more goal-oriented than a simple DC approach. It potentially could be implemented systematically and be very successful.”

The reason? Both sides gain. “This plan has features that are very attractive to corporate America and at the same time delivers a valuable benefit to workers,” said Blitzstein.

While no formal negotiations with the company have taken place, the MEC has indicated that it’s working on a proposal—and management has expressed a willingness to engage. The next step is to conduct a poll of the pilots—the third such poll in this process—to determine if they want the MEC to begin talks with the company.

Dyer’s optimistic about the negotiations should the pilots give the go-ahead. “It limits the company’s costs and provides for a defined expenditure each year, which allows for better budgeting,” he said. “It’s almost a textbook integrated negotiations model—a win-win for both sides. And if we can get this done, we go into Section 6 negotiations in 2021 with a lot of momentum.”

Conclusion

Each pilot group has its own challenges. For the FedEx pilots, this has been and remains their retirement structure. By working together, clearly articulating the situation, and leaving no stone unturned in their quest to find a solution and develop an eventual bargaining approach, the pilots are on a path to solving their retirement concerns. While this group’s solution may not work for all ALPA pilots, it does demonstrate that there are alternative approaches to providing for life beyond the airline cockpit.