State of the North American Airline Industry

By ALPA Economic & Financial Analysis Department Staff

As economies around the world continued to recover in 2023, pent-up consumer demand for air travel drove the airline industry to almost reach prepandemic levels in terms of traffic and profitability. Global passenger numbers made a significant comeback, narrowly surpassing prepandemic levels by the peak summer months. This recovery, while uneven across different regions, marked a pivotal moment for an industry that had faced unprecedented challenges. Globally, the overall net profit for the airline industry reached approximately $23.3 billion in 2023. North American carriers, which were the first to return to profitability in 2022, collected about $14.3 billion in net profits in 2023 alone. The North American airline industry’s rapid return to profitability is a testament to its resilience and adaptability. The industry isn’t just recovering; it’s actively reshaping itself for a new era of growth and competition.

Global Economy Remains Resilient Despite Uneven Growth

Just as the airline industry has emerged from the pandemic, showing signs of robust recovery and resilience, so has the global economy. Worldwide economic activity was surprisingly resilient in 2022 and 2023. As global inflation decreased from its peak, economic activity grew steadily, defying warnings of stagflation and recession.

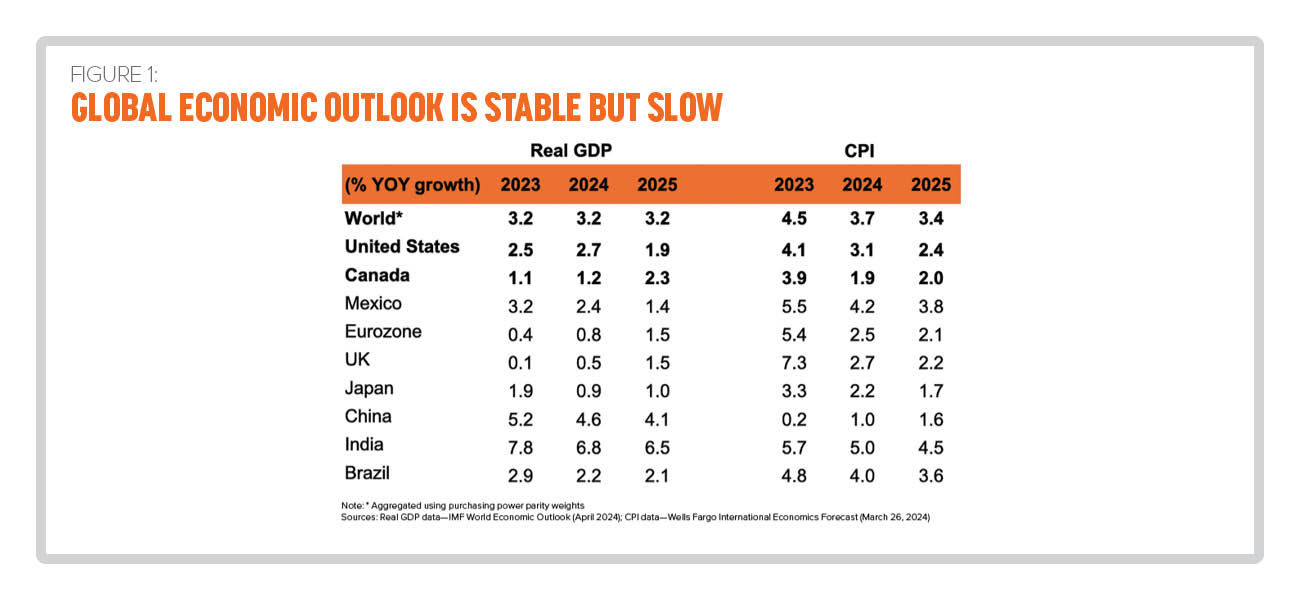

The most recent World Economic Outlook from the International Monetary Fund reported that global growth was 3.2 percent in 2023 and projects the same pace of economic growth for 2024 and 2025. For advanced economies, growth is projected to rise from 1.6 percent in 2023 to 1.7 percent in 2024 and 1.8 percent in 2025. This growth is mainly attributed to recovery in the euro area. In emerging market and developing economies, growth is expected to be similar to the 4.3 percent increase seen in 2023, with both 2024 and 2025 projected to show 4.2 percent growth. There are regional differences in expected economic growth among emerging market and developing economies, with Asian economies outperforming Latin American and Caribbean economies.

The Eurozone and UK economies are moving toward gradual recovery phases, and China’s economy is showing reasonably solid activity. Growth in the Eurozone is expected to recover from its low rate in 2023, which reflected relatively high exposure from the war in Ukraine. Stronger household consumption and a fall in inflation, which will support growth in real income, is expected to drive the recovery in the Eurozone. Additionally, growth in the UK is projected to rise as disinflation allows financial conditions to ease and real incomes to recover (see Figure 1).

Click on any figure to enlarge.

China’s economy is affected by the enduring downturn in its property sector and growth could falter, hurting trading partners. Growth in China is projected to slow from 5.2 percent in 2023 to 4.6 percent in 2024 and 4.1 percent in 2025.

Risks to the global outlook are now broadly balanced as threats to the economic landscape have diminished over the past several months. Despite the resilient economic performance, several adverse risks to global growth remain possible. On the downside, there’s risk to spikes in food, energy, and transportation costs stemming from geopolitical tensions, including those from the war in Ukraine, the conflict in Gaza and Israel, and continued attacks in the Red Sea. Additional downside threats—such as persistent core inflation in countries in which labor markets are still tight, China’s faltering recovery, and elevated debt burdens—could dampen global growth. On the upside, looser fiscal policy could raise economic activity in the short term, and inflation could fall faster than expected amid further gains in labor force participation, allowing central banks to bring easing plans forward.

Prospects Are Brightening, but U.S. Economy Isn’t in the Clear

The U.S. economy remained resilient through the end of 2023, with output growth for the full year accelerating from 2022’s gain despite higher interest rates. There are still signs that economic momentum is slowing as the household saving rate continues to run below prepandemic levels and declining job openings are flagging a softening in the labor market.

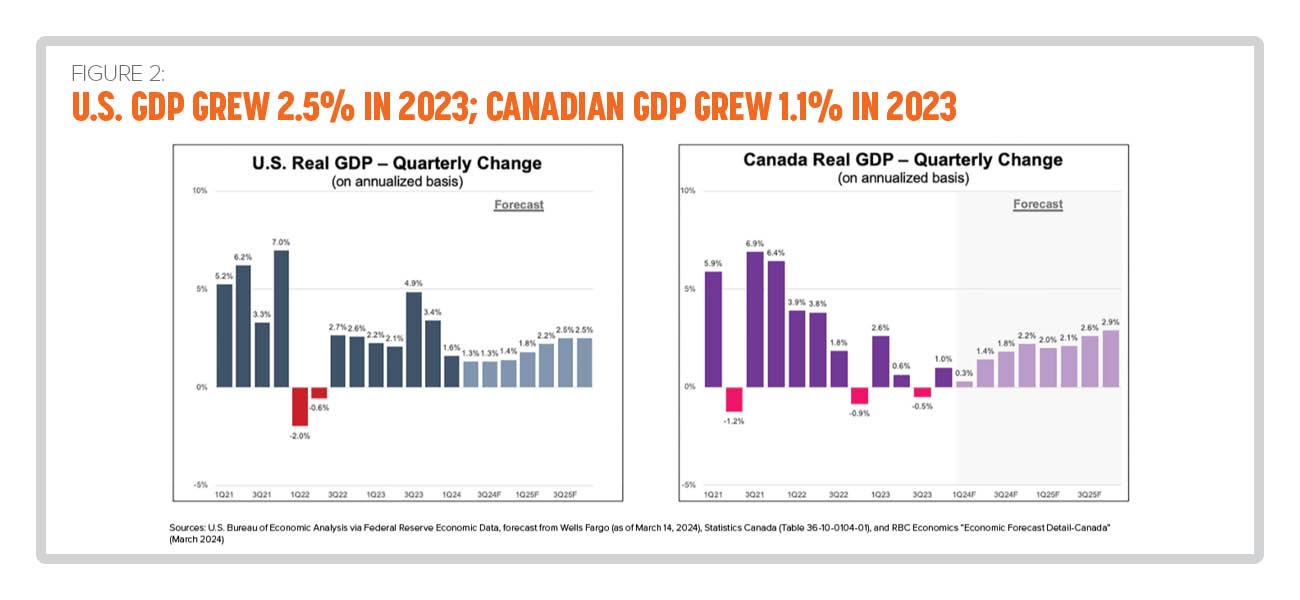

U.S. real gross domestic product (GDP) grew 2.5 percent in 2023, higher than the 1.9 percent increase in 2022. The rise in real GDP in 2023 primarily reflected increases in consumer spending. Real GDP in 2024 will likely be higher than previously forecast, but the persistence of high interest rates suggests that recent growth rates won’t be maintained as 2024 first-quarter real GDP only grew 1.6 percent. Real GDP is projected to rise 2.7 percent in 2024 and 1.9 percent in 2025 (see Figure 2).

The labor market continues its stellar production of jobs, as March 2024 marked the fourth consecutive month of nonfarm payroll employment gains above 250,000. The brief slowdown in job growth that was seen at the end of 2023 appears now to have been an aberration rather than the continuation of a trend. Moreover, average hourly earnings growth has been solid; it’s worth noting that earnings growth has slowed recently as much of the job growth over the last half year has been concentrated in lower-paying services. The unemployment rate in March 2024 stood at 3.8 percent. Unemployment has firmly remained below 4 percent for the past two years—the longest streak since the late 1960s—and all demographic groups are enjoying low levels of joblessness. The employment forecast projects a slowdown in the labor market as employers pull back on hiring—not, as many headlines indicate, because of an increase in layoffs.

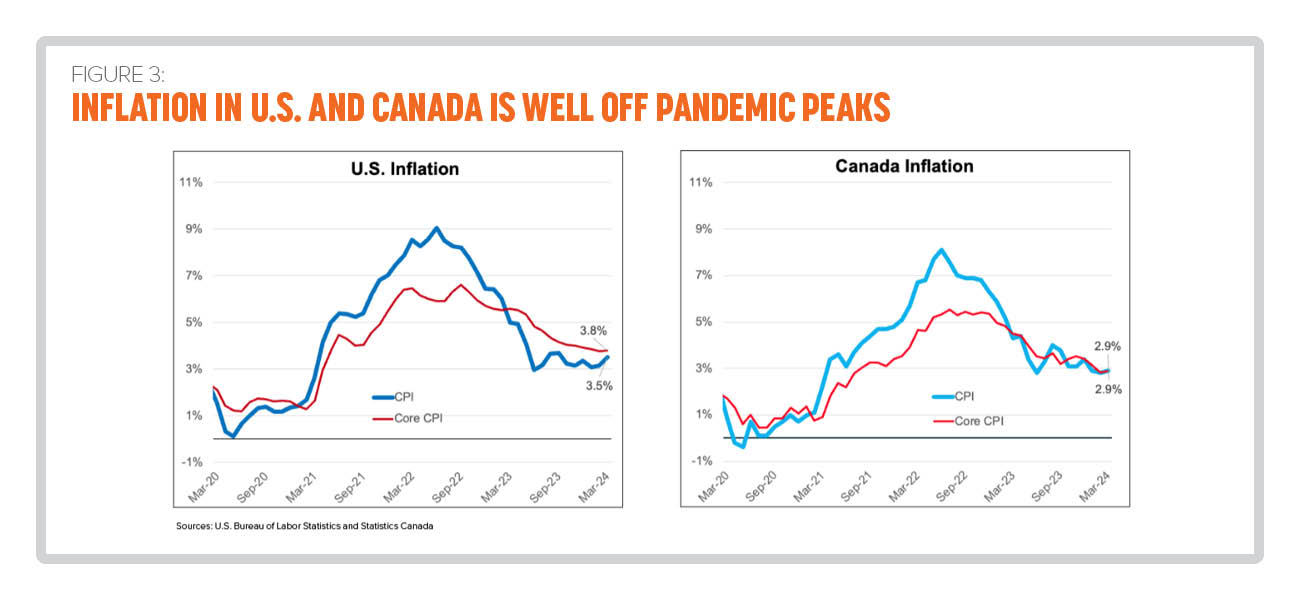

The annual inflation rate in the U.S. accelerated for a second straight month to 3.5 percent in March 2024, the highest since September 2023, mostly driven by higher gasoline prices. Both the headline Consumer Price Index (CPI) and the core CPI, which excludes food and energy, rose 0.4 percent in March as the three-month annualized rate of core CPI inflation climbed to 4.5 percent, the fastest pace since May 2023. The question remains as to when the Federal Reserve will begin to cut rates as inflation looks to be increasing and moving away from its 2 percent target rate. The Federal Reserve is expected to continue to hold rates steady over its next few meetings as the first rate cut is now expected to take place no sooner than September. Despite the acceleration in core prices in the first quarter of 2024, it’s expected that inflation will trend lower throughout the year, but progress will likely be gradual (see Figure 3).

Consumer attitudes are closely monitored as their confidence levels tend to impact their spending behavior. Given that consumer spending accounts for approximately 70 percent of the economy, it has a major impact on economic growth. In March, the University of Michigan consumer sentiment survey reached its highest level since July 2021. With most of the recent improvements in sentiment coming between November 2023 and January 2024, consumer views have recently stabilized into a holding pattern; consumers perceive few signals that the economy is currently either further improving or deteriorating. Additionally, the upcoming November presidential election remains a significant factor in consumers’ attitudes and future perceptions for the economy’s trajectory.

Canadian Economic Outlook Is Lackluster

The Canadian economy is slowing as the lagging impact of earlier interest rate increases materializes. Furthermore, Canada’s economy is underperforming its peers as GDP isn’t growing fast enough to keep up with the rapid population growth. Canada’s economic weakness is also reflected in the rapidly slackening labor market. Hiring is no longer keeping pace with population growth, and this has been particularly glaring in the private sector since mid-2023. However, there’s been significant progress on most indicators of underlying inflation.

Canada’s real GDP grew 1.1 percent in 2023, the third consecutive year of expansion, albeit at the slowest pace since 2016, as the economy faced pressure from high interest rates. Growth in GDP is expected to be modest in early 2024 and gradually improve throughout the year and into early 2025. The improvement is driven by easing financial conditions, the fading effects of past increases in interest rates, and increasing business and consumer confidence. Real GDP is projected to rise 1.2 percent in 2024 and 2.3 percent in 2025.

Canada’s labor market has eased considerably from its strong start in 2024. In March, Canadian employment decreased by 2,200 jobs, which led to the sharpest rise in the unemployment rate in 19 months to its highest level since February 2022. The unemployment rate, which is currently 6.1 percent, has increased by 1.3 percentage points since the start of monetary tightening, with young people and immigrants being hardest hit. Unemployment among those 15 to 24 years old is 12.6 percent, having risen by 3.3 percentage points since the start of monetary tightening, the sharpest rise ever seen outside a recession. Furthermore, job creation has been slower than the increase in the working-age population. The decrease in employment itself is small but appears significantly weaker when measured against a surge in population of 91,000 and a rising labor supply in March.

In a similar trajectory to the U.S., both headline and core inflation in Canada ticked up to 2.9 percent in March 2024 from 2.8 percent in February 2024. The CPI increased primarily due to higher gasoline prices in the month because of rising oil prices that are tied to heightened supply concerns with ongoing geopolitical tensions. Meanwhile the core CPI edged up due to higher rent costs. Despite the increase in the CPI in February and March, the overall inflation trend is slowing as monetary policy works to reduce inflationary pressures. Inflation is projected to return to the Bank of Canada’s 2 percent target in 2025 due to the impact of ongoing excess supply. Labor costs are projected to moderate further as wage growth continues to slow, bringing these costs in line with inflation and modest productivity growth.

High inflation and high interest rates continue to impact consumers, but sentiment is improving. Consumers still feel the negative effects of inflation and interest rates on their spending as nearly two-thirds are cutting or postponing spending in response, and the cost of living remains their top financial concern. Although weak, consumer sentiment improved this quarter, with expected lower interest rates. As a result, consumers are less pessimistic about the future of the economy and their financial situation, and fewer think they’ll need to further cut or postpone spending. Workers continue to feel positive about the labor market and, with inflation expected to be high, they continue to anticipate stronger-than-average wage growth.

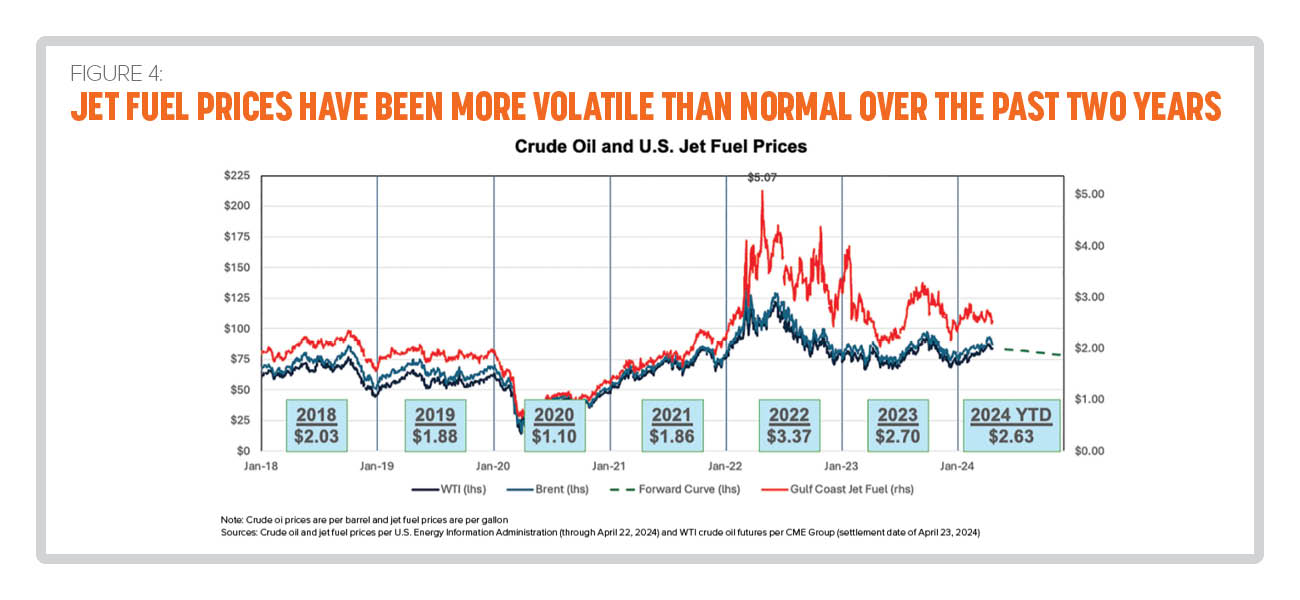

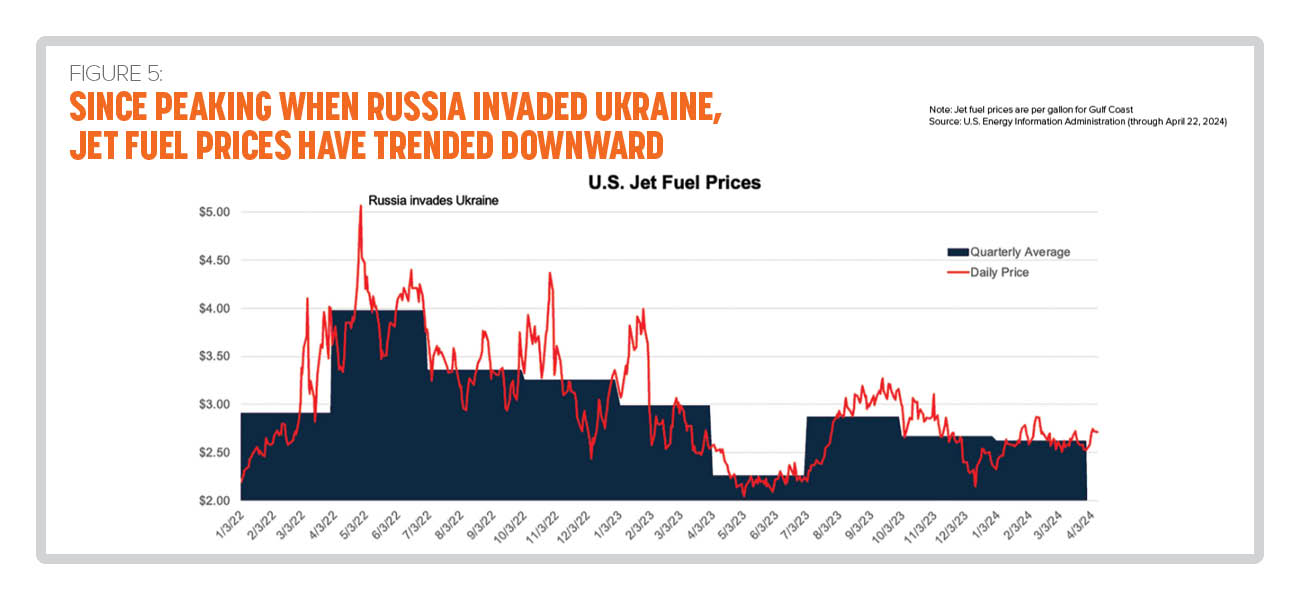

Jet Fuel Prices Have Been More Volatile Over the Past Two Years

The Brent crude oil spot price averaged $82.50 per barrel in 2023 compared to the average price of $100.93 per barrel in 2022. The price of jet fuel averaged $2.70 per gallon in 2023, significantly down from the $3.37 per gallon average in 2022. As a result, jet fuel prices decreased by 15 percent for U.S. passenger carriers in 2023. Despite consuming 11.7 percent more gallons of jet fuel in 2023, U.S. passenger airlines saw their fuel bill decrease by 5 percent, or $2.8 billion.

The jet fuel crack spread (the difference between the cost of jet fuel and crude oil) averaged $35.79 per barrel in 2023, about 23 percent lower than the 2022 average of $46.78 per barrel, as new capacity gains by refiners reduced refining margins. This is well above prepandemic levels, when the crack spread was $9 to $22 per barrel over a three-year period from 2017 to 2019 (see Figures 4 and 5).

Jet fuel prices are expected to remain relatively stable this year with fluctuations gradually going down; however, ongoing conflicts in the Middle East may cause supply disruptions, leading to increased volatility.

A factor that may impact airlines’ overall fuel bill is the aviation industry’s increasing use of sustainable aviation fuel (SAF) to reduce its carbon footprint. The impact will depend on the medium- and long-term cost of SAF production and the continued availability of government tax credits to offset some of the existing cost differential. Currently, although SAF costs anywhere from two to six times as much as traditional jet fuel—depending on the price of jet fuel, the cost of renewable feedstocks, and production costs, among other factors—airlines are purchasing as much SAF as they can. The International Air Transport Association estimates the use of SAF could rise to 0.53 percent of global airlines’ total fuel consumption in 2024, adding $2.4 billion to the fuel bill.

U.S. Mainline Passenger Airline Profits Were Strong in 2023

The U.S. mainline passenger industry wrapped up an epic 2023 and started 2024 with similar expectations. Demand for air travel remained strong in 2023, with the industry steadily approaching 2019 levels of passenger traffic volume. Passenger traffic among U.S. mainline carriers, measured in revenue passenger miles, grew by 13.5 percent in 2023 compared to 2022. The evident pent-up demand and the increased appetite for premium leisure travel have compensated for the reduced volume of business travel. Consumers are exhibiting a sustained interest in travel, and for many that interest may be shifting from a reactionary impulse to a redefined priority.

In response to the robust demand for travel, U.S. carriers deployed more capacity in 2023, primarily to leisure destinations. Capacity, measured in available seat miles (ASMs), grew by 13.1 percent in 2023 compared to 2022. Surprisingly, network carriers such as American, Delta, and United experienced capacity growth in line with ultra-low-cost carriers (ULCCs) such as Allegiant, Frontier, Spirit, and Sun Country during 2023. Network carriers grew capacity by 13.5 percent, and ULCCs grew capacity by 13.4 percent. Capacity growth for network carriers resulted from increasing international capacity, primarily on transatlantic routes, as U.S.-international ticket sales outpaced domestic sales for the majority of 2023.

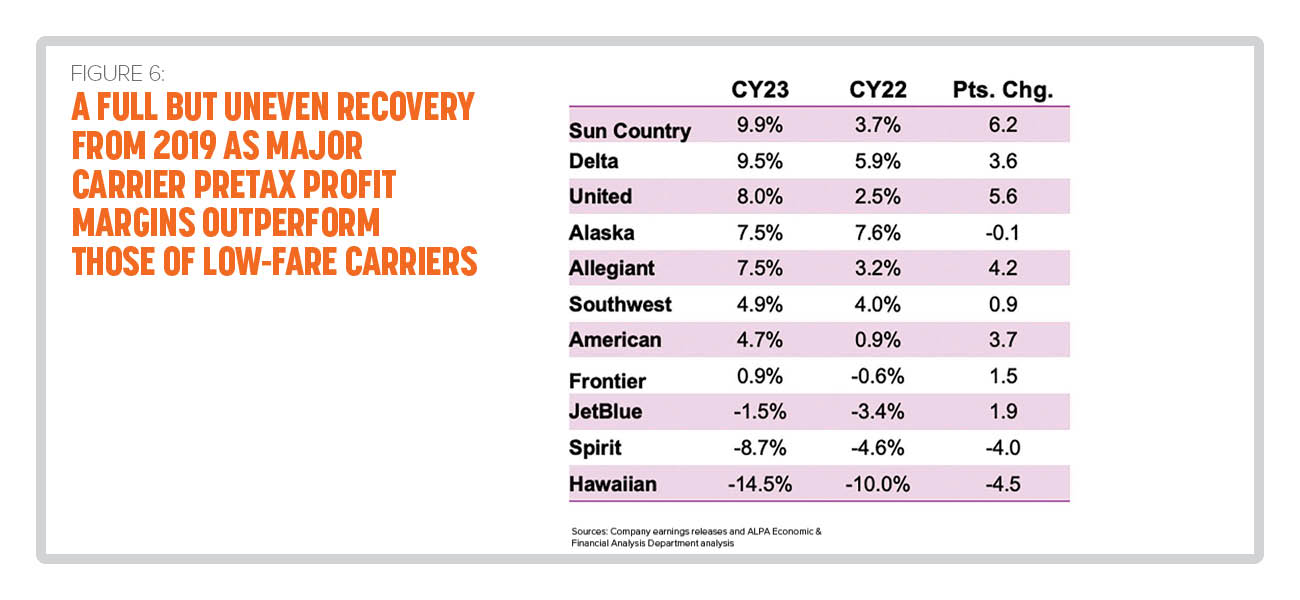

High passenger demand strengthened revenue and operating profitability for U.S. mainline passenger carriers in 2023. U.S. passenger airlines recorded $13.4 billion in adjusted pretax profits in 2023, a profit margin of 6 percent. Major carrier profits outperformed low-fare carriers due to higher demand for international travel, continued strength in demand for premium domestic travel, and more diverse and relatively high margin sources of revenue, such as loyalty programs and affiliated credit cards. Since the U.S. air travel market recovery, airline industry profitability has favored the large, global network carriers of American, Delta, and United, suggesting increased consumer preference for premium travel options (see Figure 6).

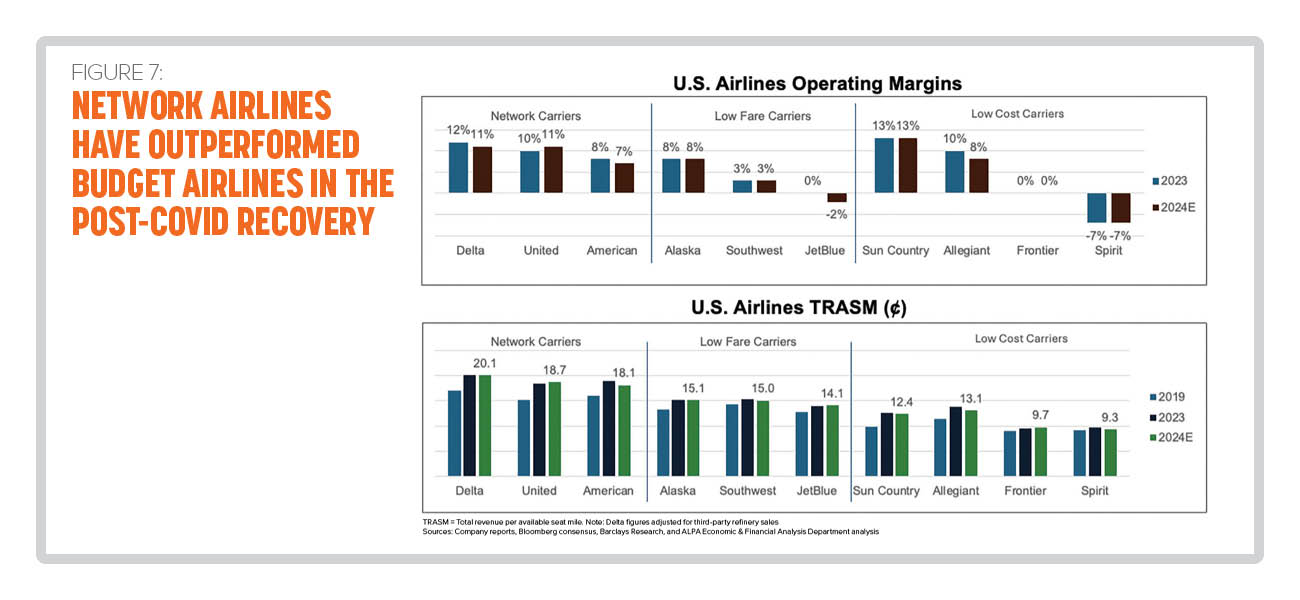

Although the initial recovery from COVID was led by leisure-oriented travel demand, which historically is the primary market focus of low-cost carriers such as Frontier and Southwest, higher-cost network airlines have been able to widen the revenue premium gap compared to prepandemic periods, as measured by total revenue per ASM (see Figure 7).

For 2023, U.S. carriers reported an increase in total operating expenses of $21.1 billion, or 11.2 percent compared to 2022. U.S. airlines faced inflationary pressures across several cost categories (e.g., labor, fuel, maintenance, rents, and landing fees). Higher labor costs remain a pressing matter for airlines due to continued staffing issues and renegotiated union compensation across pilot, cabin crew, and other employee groups. Maintenance costs have also been increasing due to similar staffing dynamics at maintenance, repair, and overhaul shops. In addition, a shortage of maintenance slots is driving up demand, and a scarcity of parts is increasing turnaround times for maintenance visits.

As a majority of U.S. airlines have returned to profitability and fortified their balance sheets within the last few years, a firmer financial footing has enabled these carriers to use free cash flow to renew fleets, upgrade IT infrastructure, and retire substantial amounts of debt accumulated in 2020 and 2021 to weather the pandemic. Total liquidity remains robust for network carriers despite raising virtually no capital in 2023. Airlines, ratings agencies, and investors embraced loyalty programs, routes, slots, gates, and brand name as collateral more than ever.

How these assets are used going forward from a debt-financing and working-capital perspective will be a key consideration as the balance sheet repair process continues into 2024. For carriers interested in pursuing capital market transactions, they need to take into consideration that the cost of capital has increased and is expected to remain elevated in 2024, as interest rates have risen in response to inflation.

Production delays and equipment malfunctions are causing havoc for airlines in need of additional aircraft to service demand. In August 2023, Boeing disclosed a manufacturing defect in its B-737 MAX that required inspections of inventory aircraft. On January 6, a door plug on a B-737 MAX 9 detached from an Alaska Airlines flight. The accident triggered an emergency airworthiness directive from the FAA for all MAX aircraft types to be grounded and inspected. As a result of the groundings, Alaska received a payment of $160 million from Boeing in the first quarter of 2024, and United Airlines reported that its first-quarter 2024 earnings were down by $200 million.

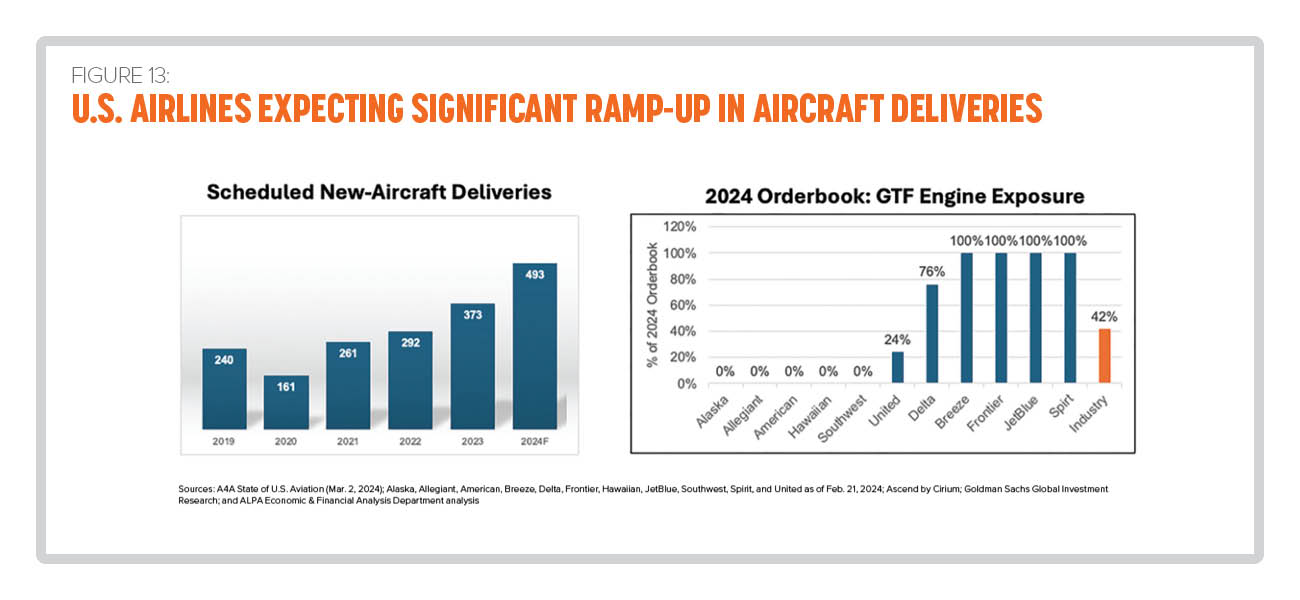

On the engine side, in September 2023 Pratt & Whitney and parent company RTX confirmed that 600 to 700 geared turbofan engines would need to be removed from aircraft for quality checks between 2023 and 2026. Consequently, Spirit entered into an agreement for Pratt & Whitney to provide a monthly credit through the end of 2024 as compensation for each aircraft unavailable for operational service.

As a result of aircraft production delays and engine issues, many carriers have slowed or paused pilot hiring and training. Southwest suspended pilot hiring, and both Alaska and American had no new hires in March 2024. United offered pilots unpaid leaves of absence for May and announced that it would halt pilot hiring in May and June. Spirit announced it intends to furlough 260 pilots effective September 1 after previously pausing pilot hiring and training.

Of note, consolidation in the industry continues to be a topic of conversation as U.S. airlines seek mergers to strengthen their offerings and financial positions. The JetBlue-Spirit merger first announced on July 28, 2022, was rejected by a federal court on January 16 on the grounds it would substantially damage competition. On Dec. 3, 2023, Alaska announced its intention to merge with Hawaiian. With the shareholders of both airlines having approved the merger, the companies are now seeking approval from the Department of Justice and the Department of Transportation.

Duopoly in Canadian Mainline Passenger Industry Is Getting Stronger, Challenging New Entrants

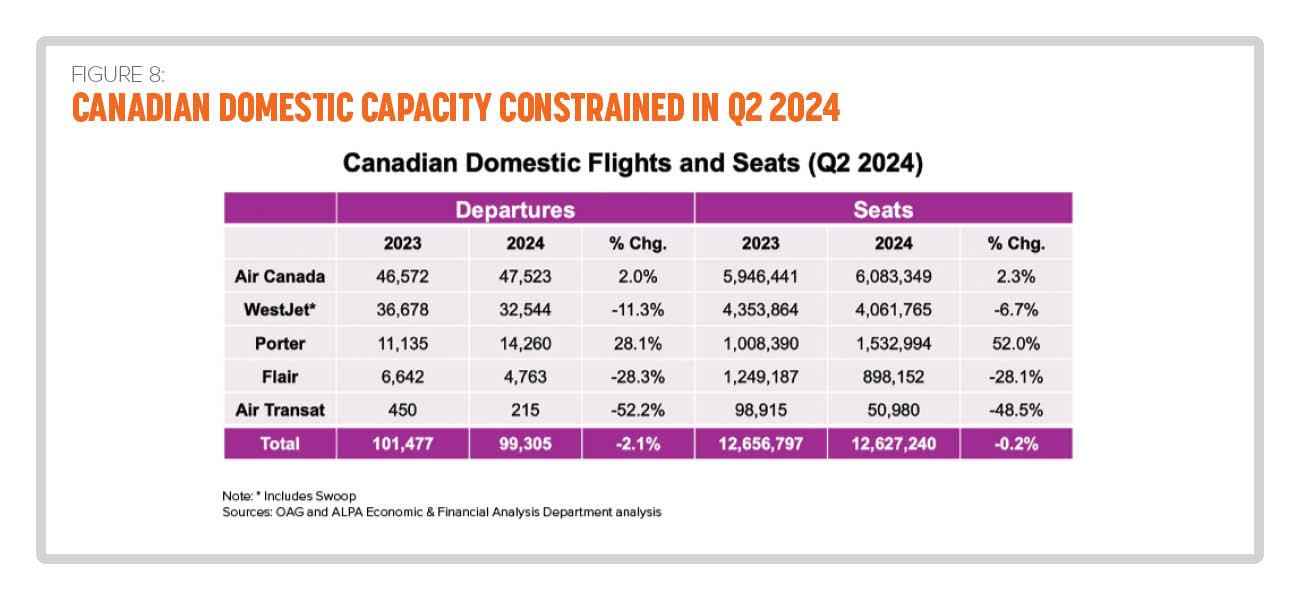

The Canadian airline industry is dominated by two large incumbents that have network and fleet advantages, making it extremely difficult for new entrants to enter the market. Canada’s aviation industry is largely dominated by Air Canada and WestJet, which have roughly 80 percent of the local market. In the U.S., that 80 percent is distributed among five carriers (see Figure 8).

The increase in Canadian leisure travel may moderate in 2024 as economic growth stagnates, reflecting the prospects of a more moderate GDP outlook, a challenged balance sheet for Canadian consumers, and the effect of higher airline ticket prices in recent years due to inflation. Canadian households are struggling with large debt, rising mortgage costs, and declining disposable income. Past rate hikes are expected to continue to hamper consumer spending, including potential spending on air travel. Passenger travel demand for Canadian airlines is expected to increase 2.9 percent in 2024 and 5.9 percent in 2025, representing roughly three times the expected GDP growth, yet still below prepandemic levels.

Air Canada’s strong financial footing, dominance in the international market, and loyalty program create a significant competitive advantage. As its network restoration is complete and its finances are solid, Air Canada is likely to shift focus to growth and network optimization. The airline’s fleet plans point to a strategy focusing on international growth. Since 2019, revenue per ASM growth has kept pace with significant inflationary cost pressures. Analysts estimate that Air Canada can generate more than $1.3 billion in free cash flow on a cumulative basis between 2024 and 2026 after funding an estimated $11 billion in committed capital toward fleet growth and modernization.

The most important development in the Canadian airline competitive landscape is WestJet’s refocus on its position of strength in Western Canada and its low-cost roots and reducing its direct competition with Air Canada on margin-challenged routes in eastern Canada. In turn, WestJet eliminated Swoop, its ULCC subsidiary, and is focusing the operations of WestJet Encore, its regional subsidiary, to Western Canada. WestJet’s acquisition of Sunwing not only makes the airline the leader in the tour vacation market, but also strengthens the airline’s position as Canada’s leading value carrier. WestJet has the largest order book of narrowbody aircraft in Canada with up to 90 B-737 MAX aircraft arriving over the next five years, with most of these being the larger MAX 10 version.

In 2022, Porter embarked on a major expansion strategy to directly compete with Air Canada and WestJet by adding additional routes out of Toronto Pearson International and Ottawa International Airports to serve new Canadian and U.S. destinations. To drive Porter’s growth, the airline signed a contract to purchase 50 Embraer E195-E2s, which it hopes to receive by the end of 2024, with an option to purchase 50 more by 2027. In November 2023, Porter and Air Transat announced that their existing code-sharing agreement had been extended to include a new joint venture between the two airlines, whose networks are highly complementary with little overlap.

Flair launched in 2017, aiming to disrupt the incumbent carriers’ economy segments while stimulating incremental demand. Flair has since consolidated its position as the leading ULCC in Canada in terms of flights and ASMs, and over the summer of 2023 it led Canadian airlines in on-time performance and load factor, with airplanes approximately 90 percent full on average. With Lynx Air ceasing operations in late February, Flair became the only true ULCC in Canada.

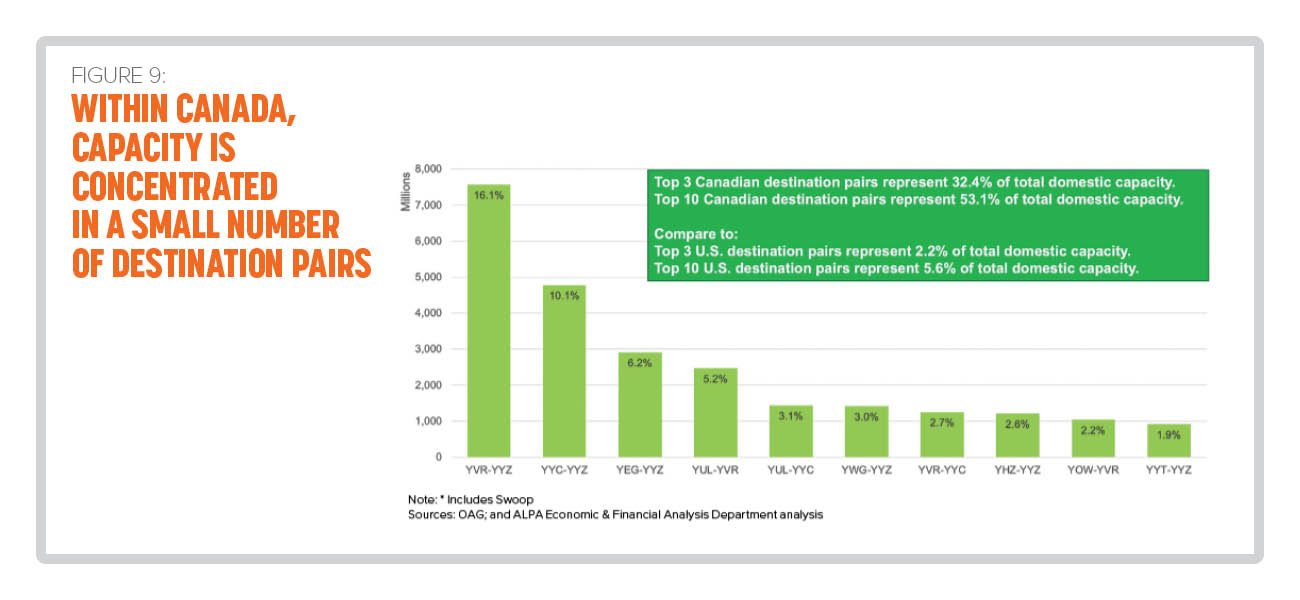

The Canadian market is structurally challenged for the traditional ULCC model (see Figure 9). Stimulating demand through pricing is more difficult in Canada because of high structural systemwide costs. As such, every flight in Canada must cover high costs for shared airport/air traffic infrastructure (including fees for airport, security, air traffic control, and taxes, among other costs) irrespective of the airline’s business model. Moreover, high infrastructure costs, a lack of secondary airports, and few high-demand routes make it extremely difficult for ULCCs to thrive in Canada. In part because of such high infrastructure costs, U.S. ULCCs have a more limited presence in Canada. Carriers such as Frontier, Spirit, and Southwest don’t fly into Canada as the high costs would impede their cost-centric business models, with the only exception being JetBlue, which flies into Vancouver, B.C.

Planned aircraft deliveries by Canadian airlines are likely to further shake up the competitive dynamics as airlines could potentially onboard up to 272 aircraft between 2024 and 2028, including 251 (or 92.3 percent) narrowbody aircraft. Aircraft deliveries to Air Canada and WestJet are expected to represent 62.2 percent of all narrowbody deliveries. While some portion of these aircraft deliveries will be used to replace aging aircraft, overall fleet growth could potentially oversaturate the domestic market. This would add to the current competitive dynamics playing out throughout the Canadian market, which have already led to start-up Lynx Air ceasing operations and served as a factor in WestJet’s acquisition of Sunwing.

Regional Industry Is Shifting Toward More Large Jets

Regional airlines have long played an important part in the dense route networks of U.S. airlines, and this likely isn’t going to change anytime soon. However, a shift in regional aircraft size is taking place. The three major network carriers—American, Delta, and United—have scope clauses that limit outsourced flying by aircraft size. At the end of 2023, Delta didn’t have any regional jets with 50 seats or less in its fleet, whereas American had 98 and United had 158. As for larger regional aircraft, American had 284 aircraft with 76 seats compared to Delta’s 223 and United’s 153.

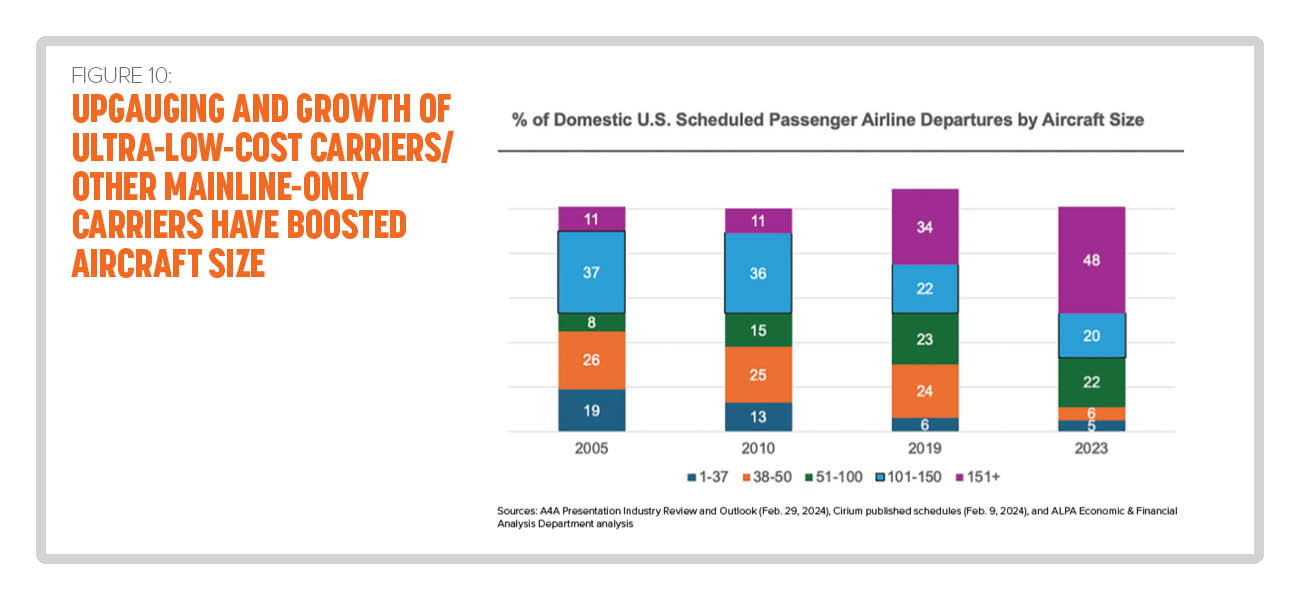

In 2023, regional carriers accounted for 33 percent of domestic departures, down from 43 percent in 2019. Furthermore, in 2023, 66.7 percent of regional flights exceeded 50 seats whereas only 53.5 percent of regional flights exceeded 50 seats in 2019. Network carriers have upgauged both mainline and regional operations (see Figure 10).

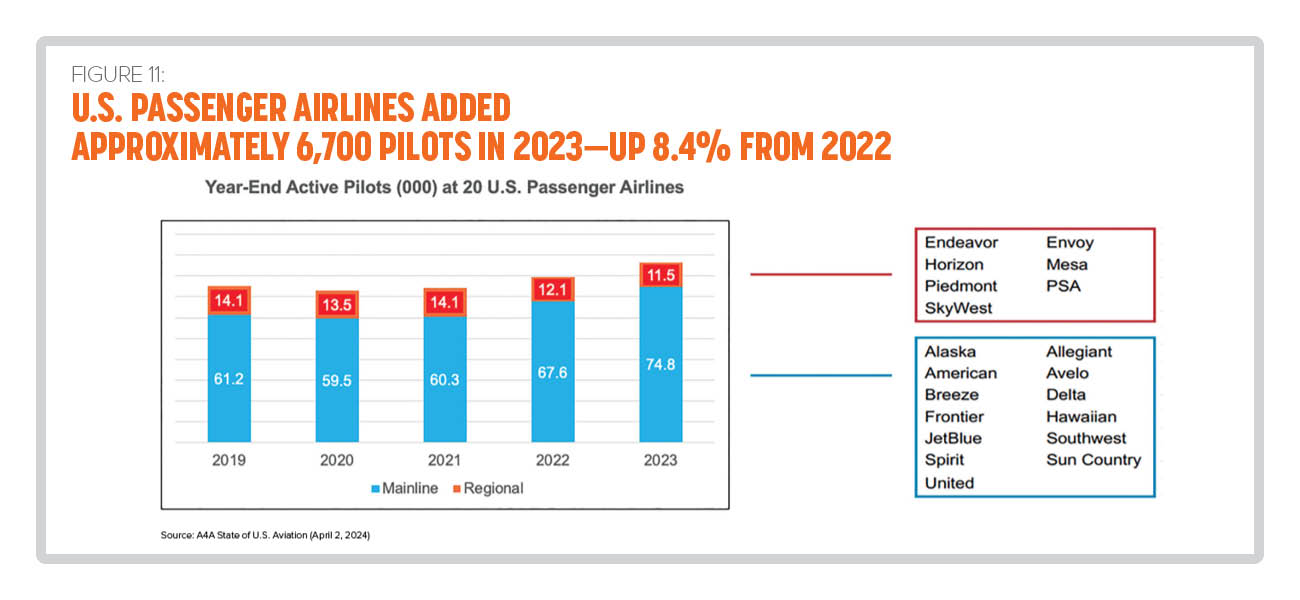

On the staffing front, the U.S. passenger industry added 6,700 pilots in 2023, with 11,000 more pilots today than in 2019 (see Figure 11). With the record number of air transport pilot certificates currently being issued, a recent Goldman Sachs report estimates that the U.S. industry has a surplus of more than 4,300 pilots this year. This surplus is enabling regional airlines to fill their hiring classes; meanwhile, the slowdown in hiring at mainline carriers is providing the time needed for first officers to upgrade to captain.

Air Cargo Industry Was Seriously Tested in 2023

The air cargo industry in 2023 faced softening demand that began in late 2022 as stagnating international trade coincided with increased passenger aircraft belly capacity. Collapsing market demand and rates dragged down revenues, forcing many all-cargo carriers to scale back operations, postpone aircraft investments, and tighten budgets.

Airlines responded by taking steps to rein in costs. FedEx Corporation implemented a multibillion-dollar campaign to eliminate structural costs and consolidate operations for improved efficiency. FedEx Express cut $700 million in annual costs by reducing its reliance on the hub-and-spoke network; consolidating routes; and leaning more on contract carriers, commercial airlift, and trucking. In addition, FedEx, along with UPS, accelerated the retirement of older aircraft and temporarily parked others. UPS even offered buyouts to nearly 200 senior pilots to reduce costs in response to shrinking parcel volumes. Air Canada reversed course on an order for two production B-777 cargo jets, and Cargojet scrapped plans to convert four B-777s into freighters. Amerijet International returned six freighters to lessors, laying off nonpilot personnel and securing $55 million in capital from existing lenders as part of a restructuring aimed at stabilizing faltering finances and operations. Losing three major customers contributed to the financial woes at Western Global Airlines, which declared bankruptcy last summer. The company restructured and was released from court protection in early December 2023. iAero Airways ceased operations in April 2024 after an unsuccessful effort to restructure the company under bankruptcy protection.

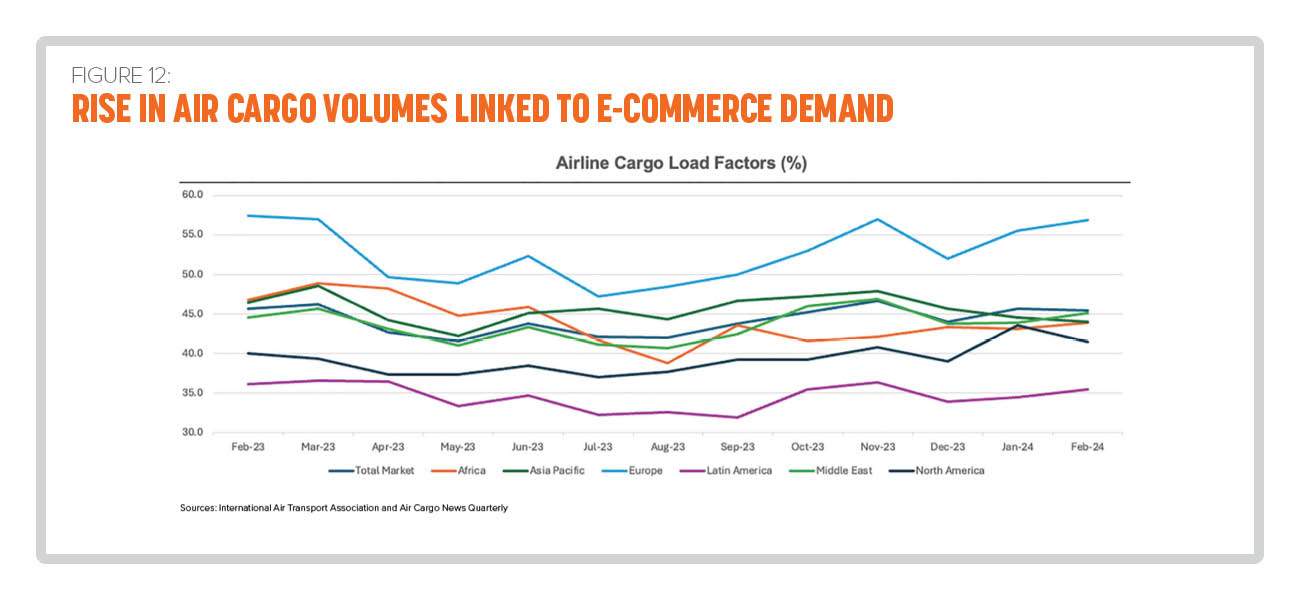

Unlike the difficult conditions faced in 2023, the global air cargo market has started 2024 on a better footing, thanks to strong e-commerce volumes out of Asia (see Figure 12) and extended transits for ocean freight being rerouted around the Red Sea’s conflict zone. March 2024 was the fourth consecutive month of double-digit year-on-year demand growth for global air cargo. The growing air cargo demand is a reflection of buoyant international traffic, which benefits from booming e-commerce. North American carriers reported a 3.1 percent year-on-year increase in demand for March 2024, which was actually the weakest among all regions.

The rate of decline in cargo revenue at Delta slowed further in the first quarter of 2024, reflecting an overall improvement in global market conditions for air freight. Delta’s cargo revenue during the first quarter fell 15 percent to $178 million compared to a decline of 36 percent and 24 percent in the third quarter of 2023 and the fourth quarter of 2023, respectively. In contrast, United, buoyed by a significant recovery in market conditions, delivered surprisingly strong cargo results in the first quarter. The carrier reported cargo revenue of $391 million, a notably small decline of just 1.8 percent from the same three-month period in 2023.

In October 2023, Hawaiian began flying cargo within Amazon’s air-logistics network. It will receive A330-300 converted freighters, provided by Amazon, in 2024 and eventually operate 10 freighters for the e-commerce giant.

In April 2024, UPS announced that it will replace FedEx as the dominant provider of domestic air cargo for the U.S. Postal Service for the first time in more than 20 years. UPS stated that it won’t purchase additional aircraft but will hire additional pilots to support the anticipated increase in air cargo demand.

Overall Industry Outlook Remains Positive

The outlook for the North American airline industry remains cautiously optimistic. Recovery is expected to continue, albeit at a slightly moderated pace, and revenue growth is projected to be robust. However, this optimism is tempered by the need for the industry to effectively balance supply with demand, especially considering rising input costs. Airlines will continue to see challenges from macroeconomic factors like inflation, volatile fuel prices, higher interest and lease rates, and wage increases. Moreover, aircraft delivery delays are expected to be the determining factor on capacity ambitions in 2024 (see Figure 13), with most airlines likely to take a more cautious approach, particularly given the demand uncertainty. Capacity constraints may begin to impact income growth as the availability of aircraft becomes even more scarce and more costly.

ALPA’s Economic & Financial Analysis Department will continue to track and examine the various economic and financial indicators that impact the airline industry, as these factors play a crucial role in the career of the Association’s members and the overall airline piloting profession.